Roth conversion tax calculator 2020

Filing Status 2022 Modified AGI Contribution Limit. 2022 Roth IRA Income Limits.

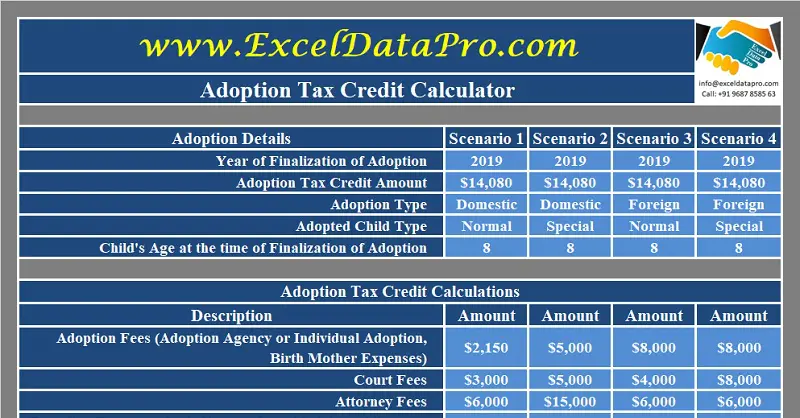

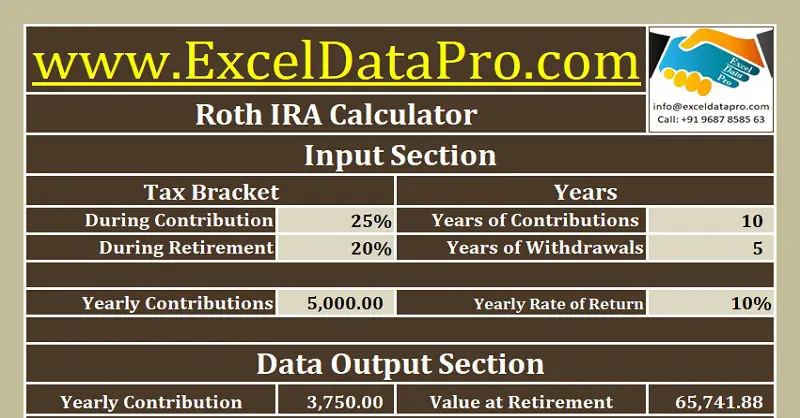

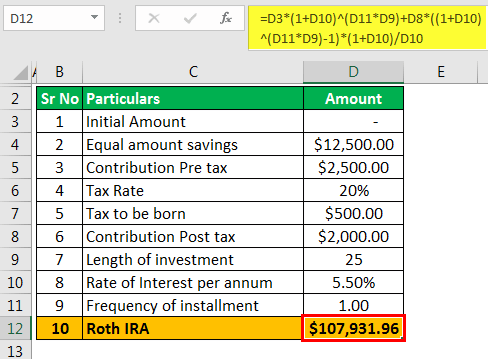

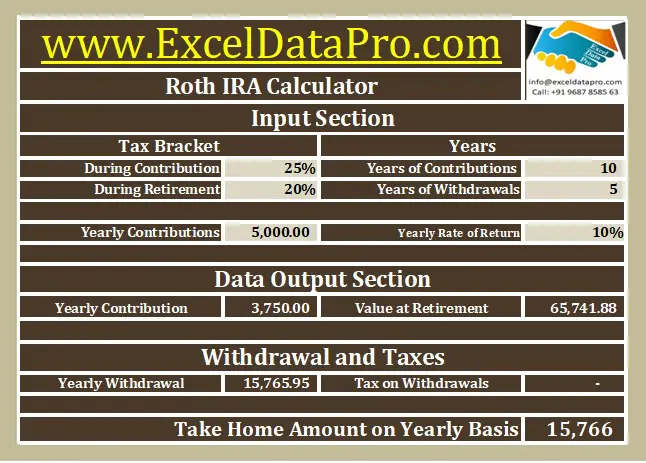

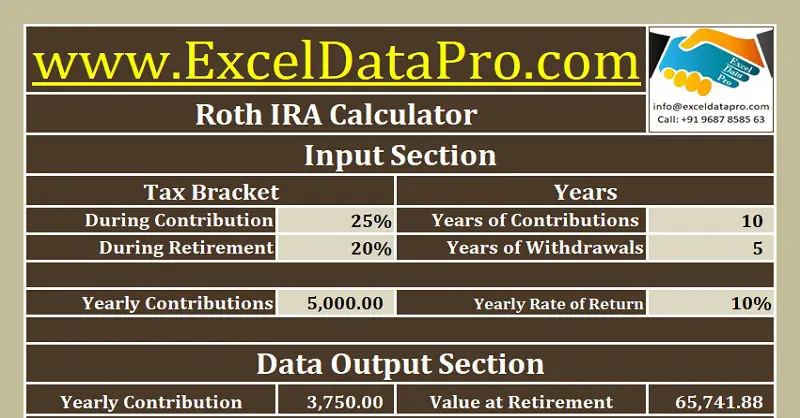

Download Roth Ira Calculator Excel Template Exceldatapro

It makes the effective marginal tax rate on the additional 10000 income 27 not 12.

. Besides the reasons listed above here are a few additional advantages to doing a Roth. Based upon IRS Sole Proprietor data as of 2020 tax year 2019. Financial calculators for all your financial needs.

With their tax-free earnings and large contribution limits Roth 401ks could be a useful addition to the retirement-savings toolbox. An IRS ruling clarified this in September 2014. Converting to a Roth IRA may ultimately help you save money on income taxes.

However due to the Trump tax cuts formally known as the Tax Cuts and Jobs Act of 2017 TCJA your federal tax rate is likely still relatively low making a Roth conversion more affordable now than years ago. Self-Employed defined as a return with a Schedule CC-EZ tax form. IRA Contribution Calculator Answer a few questions to find out whether a Roth or traditional IRA might be right for you.

We will discuss such effective and legal methods as 1031 tax-deferred like-kind property exchange 1033 exchange of condemned property how to comply with the sections 721 and 453 tax benefits of opportunity zones when selling commercial real. For instance if you expect your income level to be lower in a particular year but increase again in later years you can initiate a Roth conversion to capitalize on the lower income tax year and then let that money grow tax-free in your Roth IRA account. Add to your web site.

In 2021 and 2022 you can contribute a total of up to 6000 7000 if youre 50 or older to your traditional IRAs and Roth IRAs. The challenge with relying solely on a Roth IRA conversion calculator is that the assumptions are based on future income tax expectations. Named for Delaware Senator William Roth and established by the Taxpayer Relief Act of 1997 a Roth IRA is an individual retirement plan a type of qualified retirement plan that bears.

The answer is a definite Yes Youre permitted to roll the after-tax contributions from a. Please speak with your tax advisor regarding the impact of this change on future RMDs. To minimize the tax risks of a backdoor Roth IRA make your.

As the leader in tax preparation more federal returns are prepared with TurboTax than any other tax preparation provider. First place your contribution in a traditional IRAwhich has no income limits. I received a 1099-R tax form showing an RMD from 2020 that I returned to my IRA before the August 31 2020 deadline outlined in the CARES Act.

To get back the tax you paid on the conversion you would then need to file an amended tax return using Form 1040-X by the due date for amended returns. With a Roth IRA you contribute funds on which youve already paid income taxes. 3 min read Aug 25 2022.

Mortgage calculators retirement calculators cash flow calculators saving calculators college calculators credit calculators debt calculators tax calculators insurance calculators paycheck calculators benefit calculators qualified plan calculators and investment calculators. Best time of the year to retire for tax purposes When you retire can potentially have a big impact on your retirement income and the taxes you owe. 6000 7000 if youre age 50 or older.

IRAs 401ks and More. If this form isnt included in your 2020 return youll need to fill out a 2020 Form 8606 to record your nondeductible basis for conversion and mail this form to your designated IRS office. Normally its a good idea to consider Roth conversion or harvesting tax gains in the 12 tax bracket but those moves become much less attractive when you receive a premium subsidy for the ACA health insurance.

The conversion would be part of a 2-step process often referred to as a backdoor strategy. If you withdraw less than the RMD amount you may owe a 50 penalty tax on the difference. Traditional IRAs 401k vs IRA IRA Roth Conversion How to convert to a Roth IRA online Start simple with your age and income.

Married filing jointly or qualifying widower Less than 204000. It completely negated the need to take an RMD for the 2020 tax year. Then move the money into a Roth IRA using a Roth conversion.

Usually you have three years after the date you filed the original return but you shouldnt wait that long to seek a refund from reversing a Roth conversion What to show on your tax return. Join us now to hear more about Gift and Estate Tax Opportunities Charitable Planning Inflation and Tech Volatility. This comprehensive guide explains how to avoid or reduce capital gains tax CGT when selling a commercial property.

Bob an employee leaves Company A on December 31 2020. You can restart or begin taking your RMDs in 2021 for the 2021 tax year without the need to take one retroactively for 2020. A conversion can get you into a Roth IRAeven if your income is too high.

2020 and before December 31 2020. Roth IRAs have no RMDs during the owners. Plan provides that contributions must be allocated as of June 30.

Roth IRA vs. Retirement Saving for Retirement. If the conversions are tax free that means he will have avoided paying any tax on the money tax-free contributions to 401kTraditional IRA tax-free growth within the retirement accounts tax-free conversion from 401kTraditional.

1 online tax filing solution for self-employed. From IRS Publication. The financial planning and tax community wasnt sure for many years whether after-tax funds in a company plan could legally be rolled into a Roth IRA.

If your conversion includes contributions made in 2021 for 2020 youll need to check your 2020 return to make sure it includes Form 8606 Nondeductible IRAs. Tax deductions may be an effective strategy to lower the tax cost of a Roth IRA conversion. Pick investments for your IRA Roth vs.

Asset Allocation in Trying Times. IRS Rules About Rolling After-Tax Funds to a Roth. Calculate Your Direct Mail ROI.

The difference between a traditional IRA and a Roth IRA comes down to taxes. However you must first have the financial resources and a desire to gift to a charitable organization to use. A Roth IRA even via a conversion has the potential to benefit your retirement and legacy planning.

Americas 1 tax preparation provider. Other Advantages to a Roth Conversion. A conversion of a traditional IRA to a Roth IRA and a rollover from any other eligible retirement plan to a Roth IRA made after December 31 2017 cannot be recharacterized as having been made to a traditional IRA.

Compound Interest Calculator Roth Ira Flash Sales 51 Off Www Ingeniovirtual Com

Income Tax Calculator Estimate Your Federal Tax Rate 2019 20

Download Roth Ira Calculator Excel Template Exceldatapro

Download Roth Ira Calculator Excel Template Exceldatapro

There S A Big Difference Between A Roth Ira And A Traditional Ira Find Out Which Is Best For Retirement Savings Traditional Ira Roth Ira Ira

Traditional Vs Roth Ira Calculator

Retirement Withdrawal Calculator How Long Will Your Savings Last In Retirement Updated For 2020 Investing For Retirement Personal Finance Lessons Spending Money Wisely

Download Roth Ira Calculator Excel Template Exceldatapro

Traditional Vs Roth Ira Calculator

Tax Calculator Estimate Your Income Tax For 2022 Free

Roth Conversion Calculator Solo 401k

Form 1040 Income Tax Return Irs Tax Forms Income Tax

Roth Ira Conversion How To Convert Without Losing Money Or Paying Taxes

Roth Ira Calculator Roth Ira Contribution

Roth Conversion Calculator Fidelity Investments

Net Worth Tracking Net Worth Calculator Investment Tracker Etsy Video Video Planner Inserts Printable Net Worth Planner Lettering

Use My Retirement Calculator To Keep Your Money Away From The Government By Converting Your Ira To A Roth Ira Retirement Watch